2025 Holiday Shopping Recap: Social Video Insights + Strategy

Author :

Luke Bae

Published :

Jan 9, 2026

This 2025 holiday shopping recap is grounded in short-form social video listening across TikTok and Instagram Reels. We analyzed creator videos using spoken-word transcripts, captions, and repeated content formats to identify the season’s most consistent behavioral and sentiment patterns.

The headline insight: holiday spending didn’t freeze. It evolved. Shoppers became more calculated, optimizing for control (budgeting), convenience (delivery + pickup), and emotional payoff (self-gifting).

Methodology: Short-form Social Video Listening (TikTok + Instagram Reels)

This analysis synthesizes themes from the provided dataset of short-form social videos using:

Transcripts (what creators say out loud)

Captions + on-screen text (what they frame as the hook)

Recurring formats (haul, unboxing, GRWM, store walkthroughs, gift guides)

Behavioral evidence (in-store footage, pickup workflows, shopping pain points)

Here's how the high-level metrics unfolded in this analysis:

Total Volume: 2,147 posts (TikTok leads with 1,172 vs. Instagram 975)

Total Views: 368.4M (TikTok dominates with 342.8M views vs. Instagram 25.6M)

Engagement: 7.3M total (TikTok drives 6.9M, indicating higher viral potential)

2025 Holiday Shopping Recap: The Rise of the “Calculated Shopper”

Holiday 2025 was defined by a contradiction that showed up repeatedly in social video:

Economic anxiety (prices, household budgeting pressure)

Strategic spending (shopping earlier, optimizing deals, limiting impulse)

Small treat behavior (self-gifting as emotional regulation)

Shoppers weren’t saying, “I’m not spending.” They were saying, “I’m spending differently.”

Social video evidence (gift-on-a-budget framing):

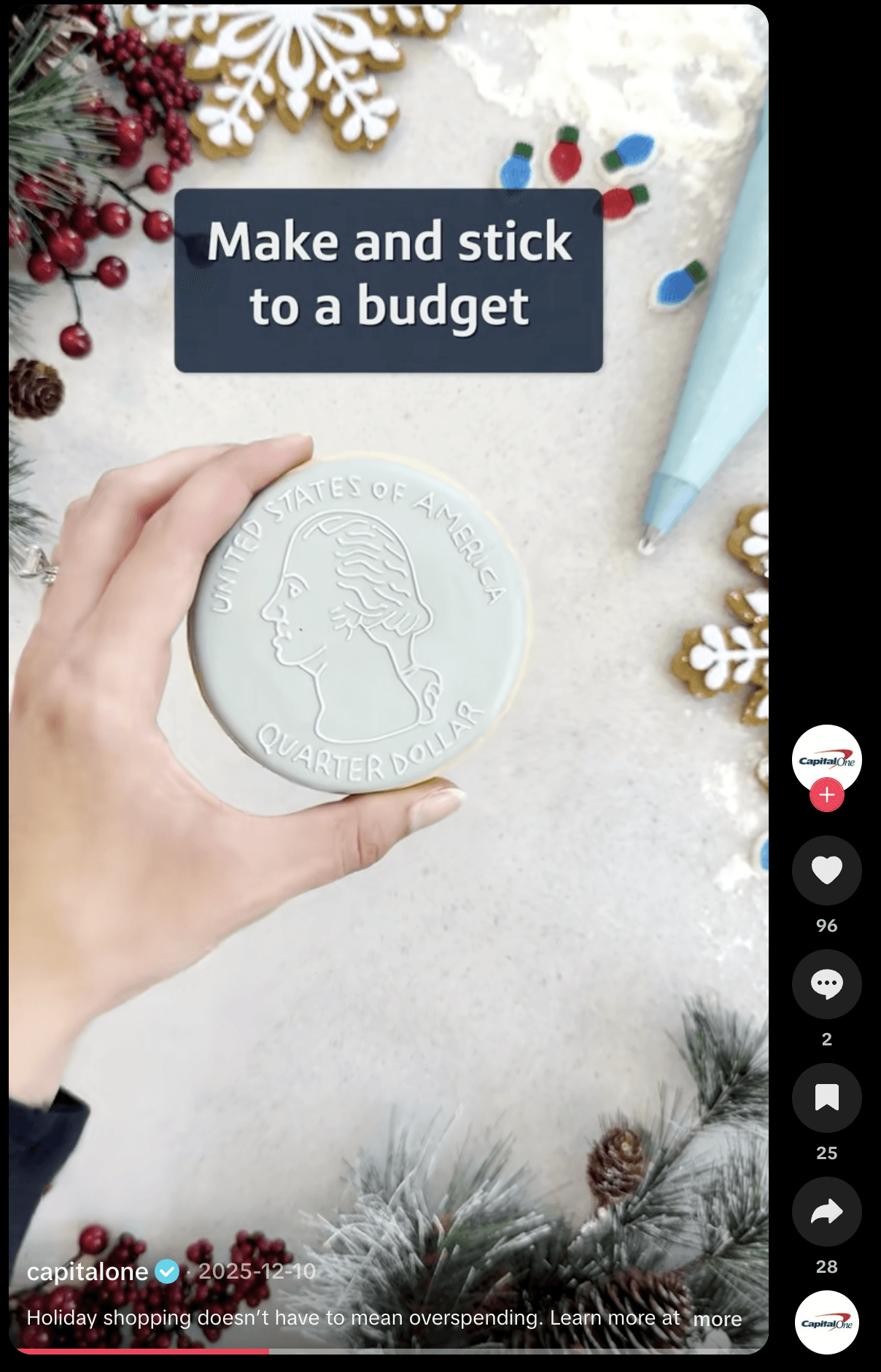

Capital One budget gifting tips: https://www.tiktok.com/@capitalone/video/7581950291411619085

Content Summary (generated by Syncly AI): The content creator shares tips to make the holidays magical while staying on budget.

Holiday Shopping Trends 2025: Early Planners vs Last-Minute Rescue Shoppers

Short-form videos made one thing obvious: the season split into two different shopper journeys.

Segment 1: Early Planners (“Finishers”)

Creators framed early shopping as a lifestyle win—peace, organization, and less stress.

“Done before December” = status + sanity

Curated lists and one-stop shops reduce decision fatigue

Evidence (early shopping haul framing):

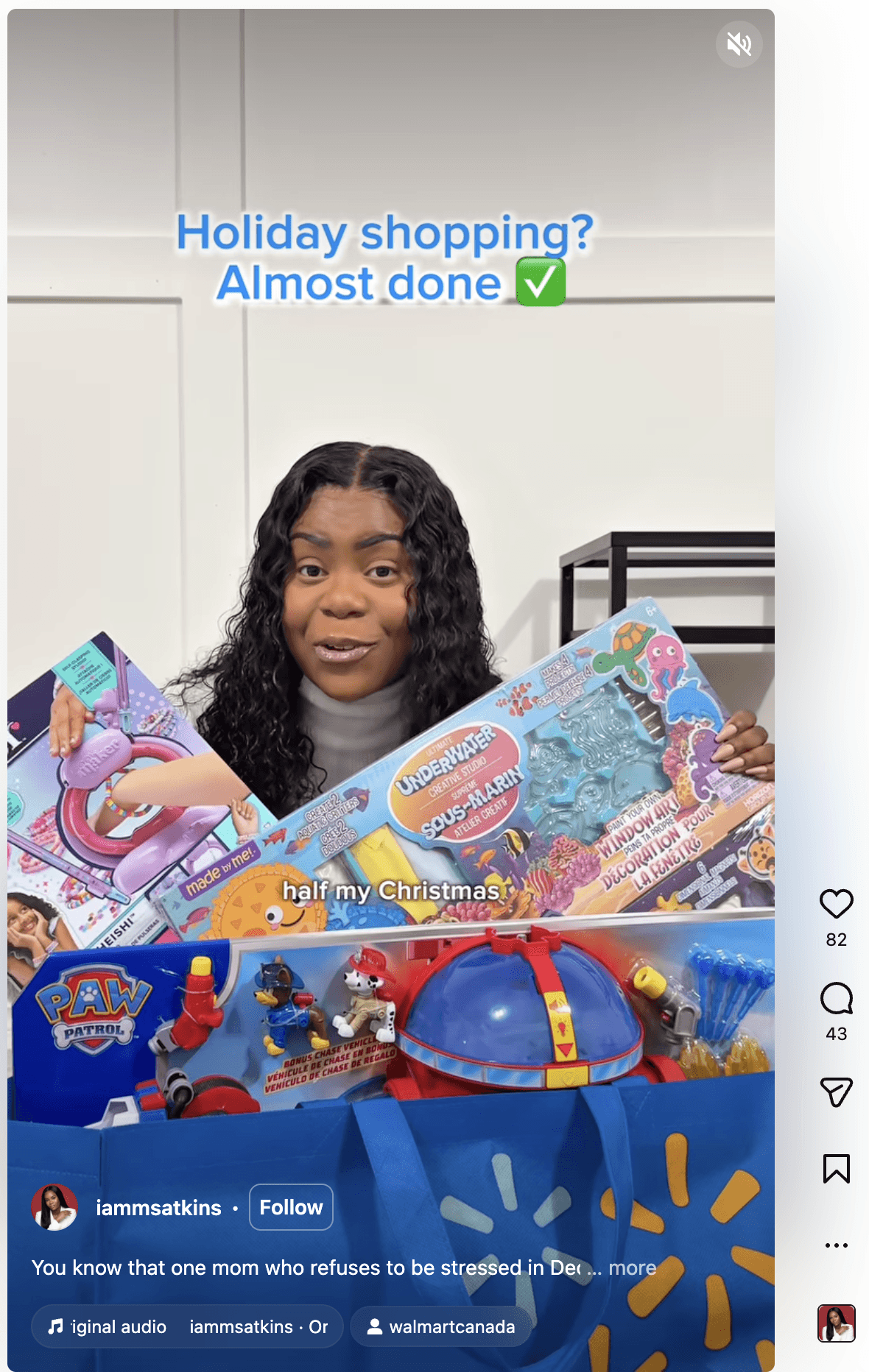

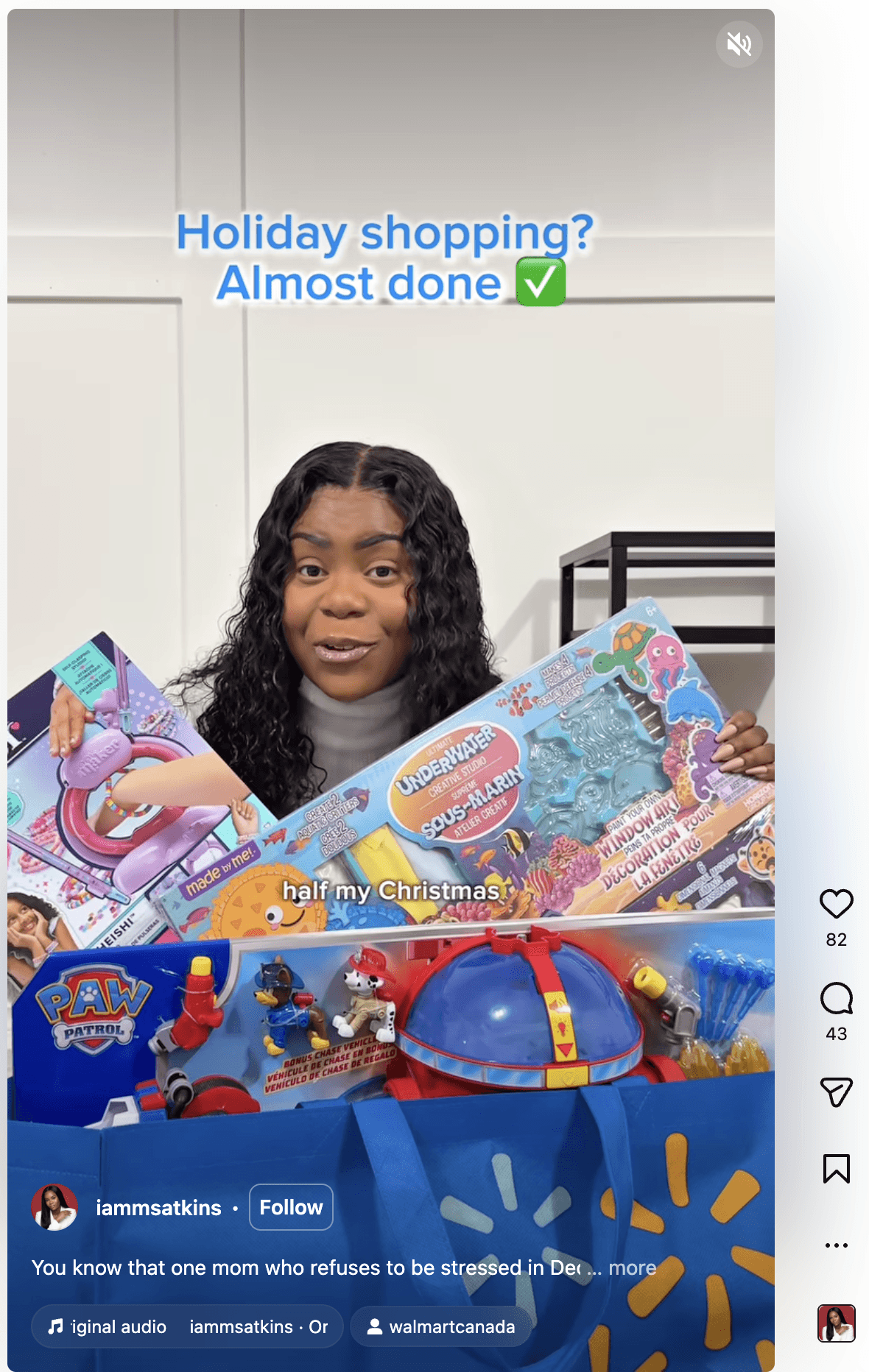

Walmart early holiday shopping: https://www.instagram.com/reels/DRP-0xCiUTT/

Content Summary (generated by Syncly AI): The content creator shares her early holiday shopping haul from Walmart, featuring gifts for her nieces and son.

Segment 2: Last-Minute Rescue Shoppers

Late shoppers weren’t optimizing price as much as optimizing certainty:

in-stock availability

delivery speed

low-effort gift solutions (bundles, stocking stuffers, “grab-and-go”)

Evidence (last-minute store run + chaos):

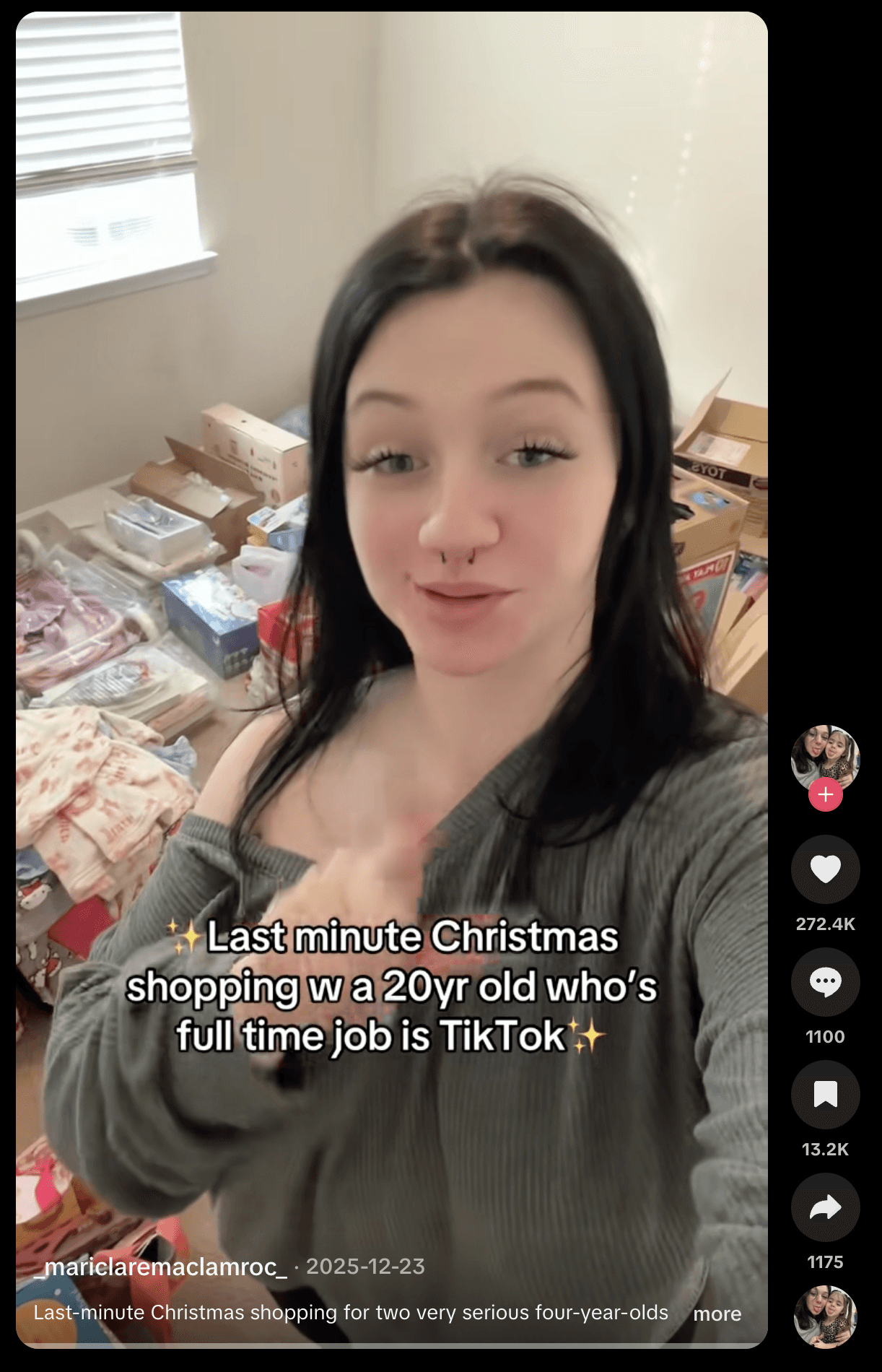

Target/TJ Maxx/Sam’s Club last-minute shopping: https://www.tiktok.com/@_mariclaremaclamroc_/video/7586792286122511671

Content Summary (generated by Syncly AI): A content creator documents their last-minute Christmas shopping trip for two four-year-olds at Target, TJ Maxx, and Sam's Club.

Marketing implication: Run two funnels.

Planner funnel: early access, curated gifts, “finish early” messaging

Rescue funnel: shipping cutoffs, BOPIS, express delivery, “gift in minutes” bundles

Holiday Consumer Behavior 2025: Budgeting Became a Ritual

Budgeting wasn’t just a constraint—it became content. Shoppers shared tactics and mindset rules:

spend-per-person caps

list-making and strict prioritization

“experiences over things” as a budget-safe narrative

Evidence (macro-to-wallet explanation + household spending pressure):

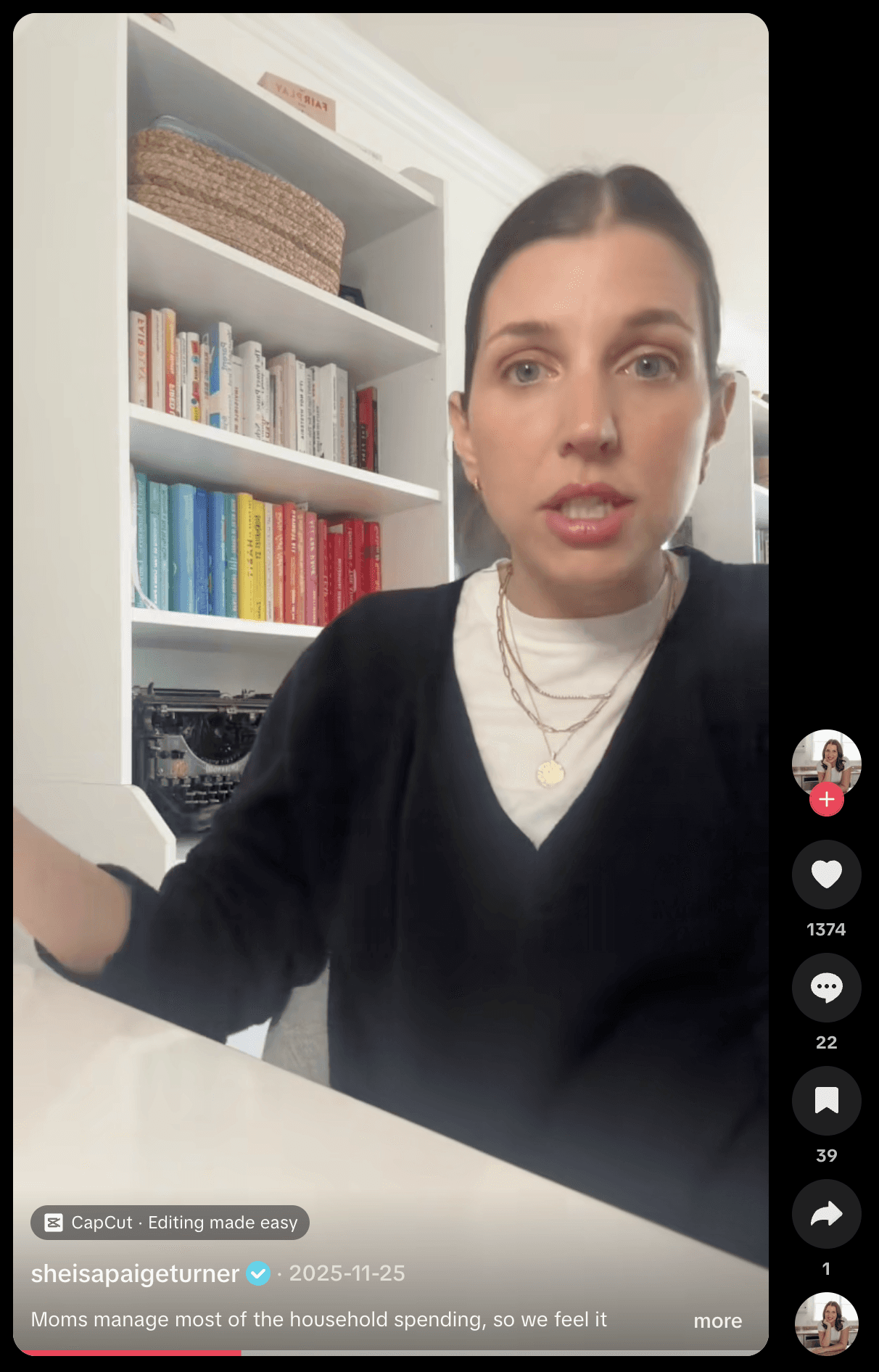

Tariffs + household budget stress: https://www.tiktok.com/@sheisapaigeturner/video/7576360223770758414

Content Summary (generated by Syncly AI): The content creator discusses how tariffs are driving up the cost of everyday goods and impacting families' budgets.

Marketing implication: If you want conversion, don’t just say “sale.”

Show why it’s worth it (value proof, utility, durability, bundle economics).

Self-Gifting Trend 2025: “Treat Yourself” as a Conversion Driver

Self-gifting wasn’t an afterthought—it was a conversion lever. Creators repeatedly normalized:

“Don’t forget yourself”

adding small items during gift shopping

low-ticket “little treats” as emotional payoff for holiday labor

Evidence (“treat yourself too” positioned as part of gifting):

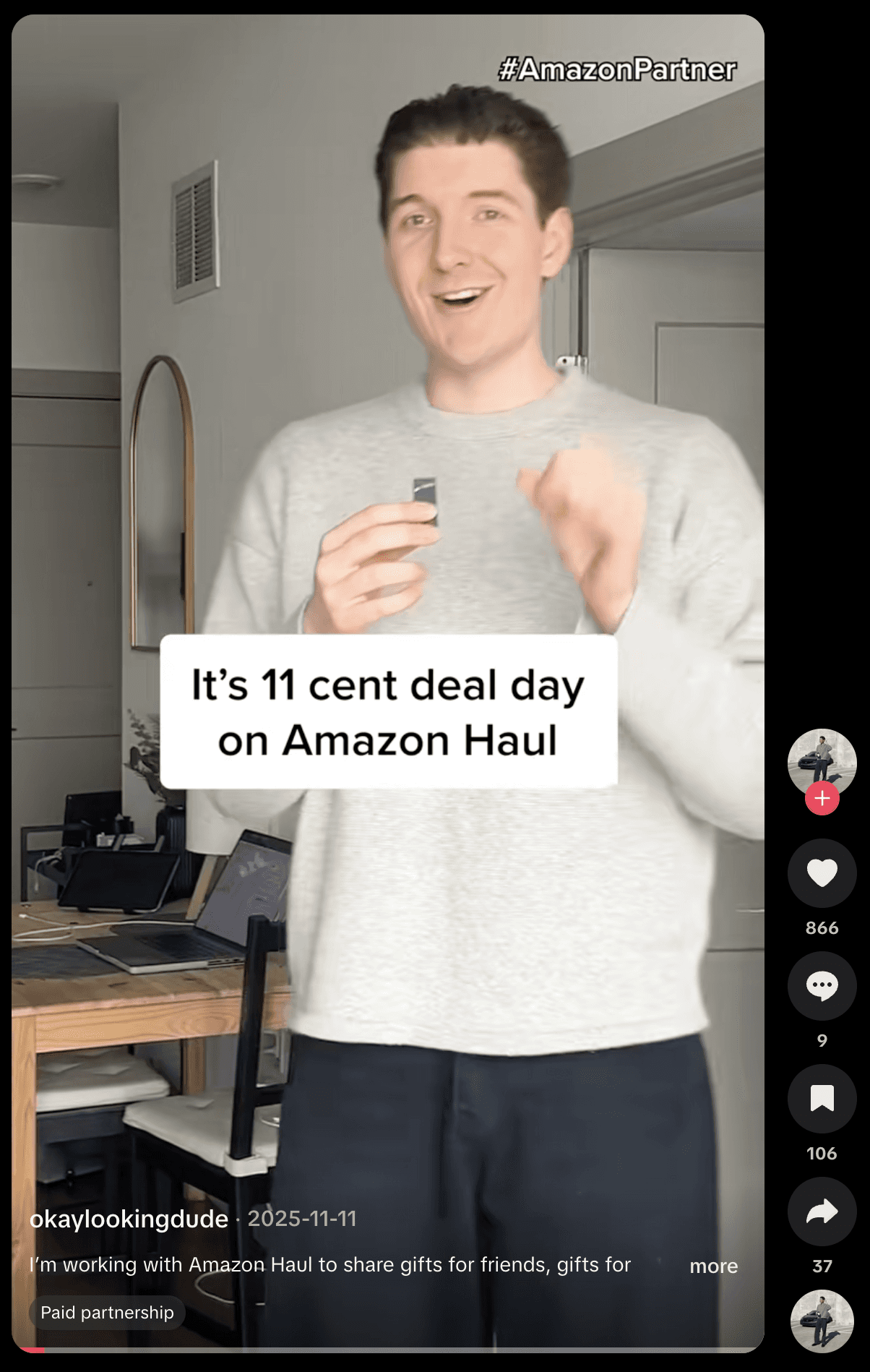

Amazon “11 cent deal day” gifting + self treat: https://www.tiktok.com/@okaylookingdude/video/7571479169347947806

Content Summary (generated by Syncly AI): The content creator discusses how tariffs are driving up the cost of everyday goods and impacting families' budgets.

What marketers should do:

Add a “Pick a little treat” module at checkout (AOV lift)

Build “Gift + Treat” bundles (guilt-reduction = higher conversion)

Use offer framing that validates the shopper’s effort (“you earned this”)

The Mall Comeback: Why Social Video Pulled Shoppers Back In-Store

A strong holiday signal: in-store shopping returned as experience + content.

Mall trips were filmed as a social ritual (“sister date,” festive vibes)

Physical retail became a content backdrop for “shop with me” formats

Visual merchandising mattered because it became shareable media

Evidence (mall as vibe + social ritual):

“Meet me at the mall” holiday shopping: https://www.tiktok.com/@meriahchristine1/video/7579031424758566174

Content Summary (generated by Syncly AI): The content creator discusses how tariffs are driving up the cost of everyday goods and impacting families' budgets.

Marketing implication: Stores aren’t just distribution. They’re a media channel.

For the 2026 Holiday Shopping Season, Brands should design for:

“filmable” curated gift corners

obvious giftable moments

quick, confidence-building wayfinding

Holiday Shopping Pain Points: Burnout, Overstimulation, Decision Fatigue

Short-form video captured real friction—especially for parents:

overcrowded aisles and overstimulation

decision fatigue from endless options

the mental load of managing family gifting

Evidence (overwhelm + preference for curated solutions):

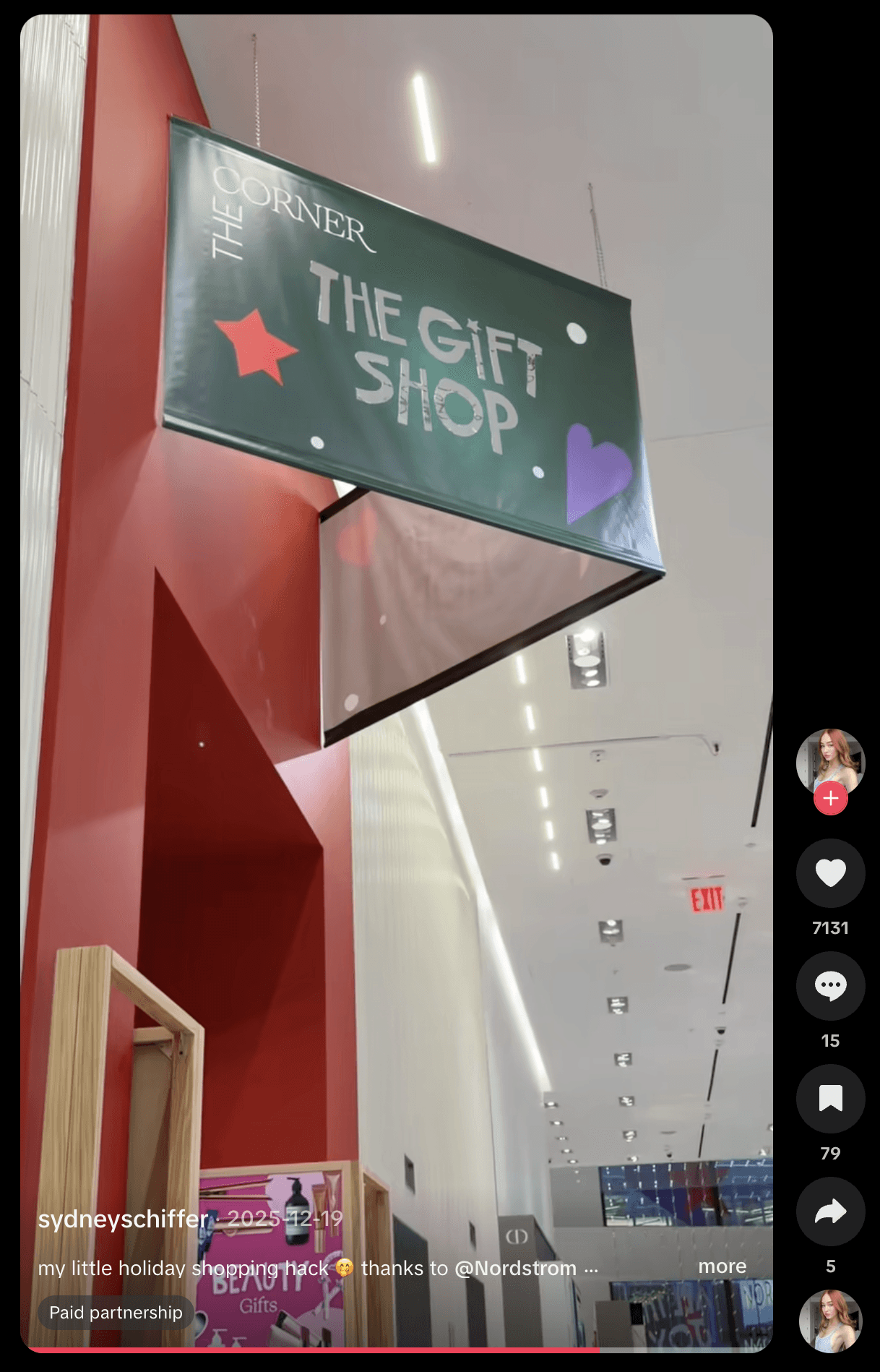

Nordstrom curated lists + easy pickup + easy returns: https://www.tiktok.com/@sydneyschiffer/video/7585282386997398797

Content Summary (generated by Syncly AI): The content creator promotes Nordstrom as a great place to shop for holiday gifts, both online and in-store.

Marketing implication: Convenience is not a feature. It’s a premium benefit.

Highlight:

curated gift lists

BOPIS speed

returns clarity

“stocking stuffer bundles” and “gift-ready sets”

What Worked in 2025: Value Density vs Vibe Density

Winning holiday strategies are clustered into two lanes:

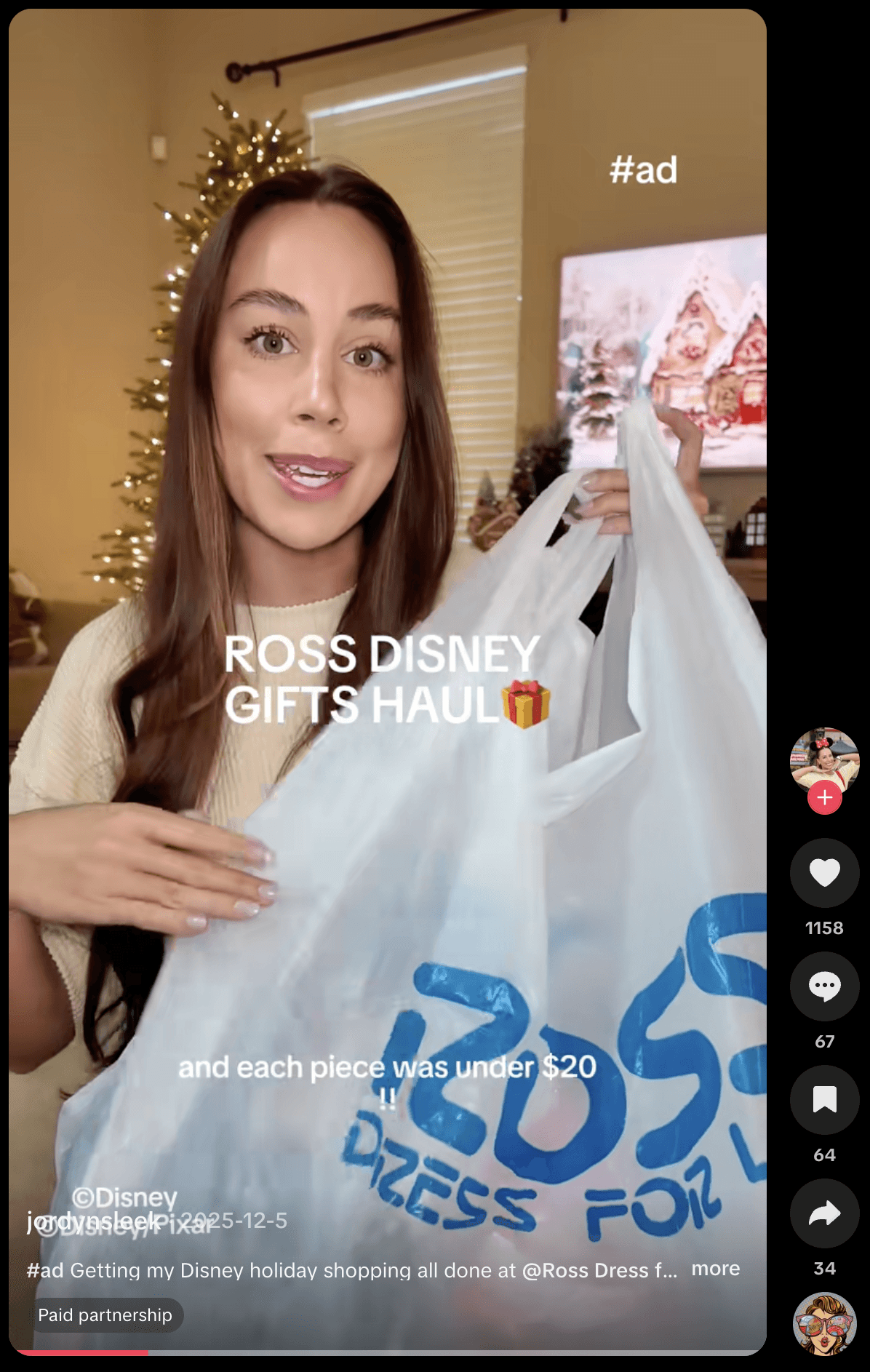

1) Value Density (Extreme value per frame)

Hauls succeed when a creator can show many items for a low total. Discount retailers thrive because “visual abundance” drives engagement

Evidence (under $20 gift haul):

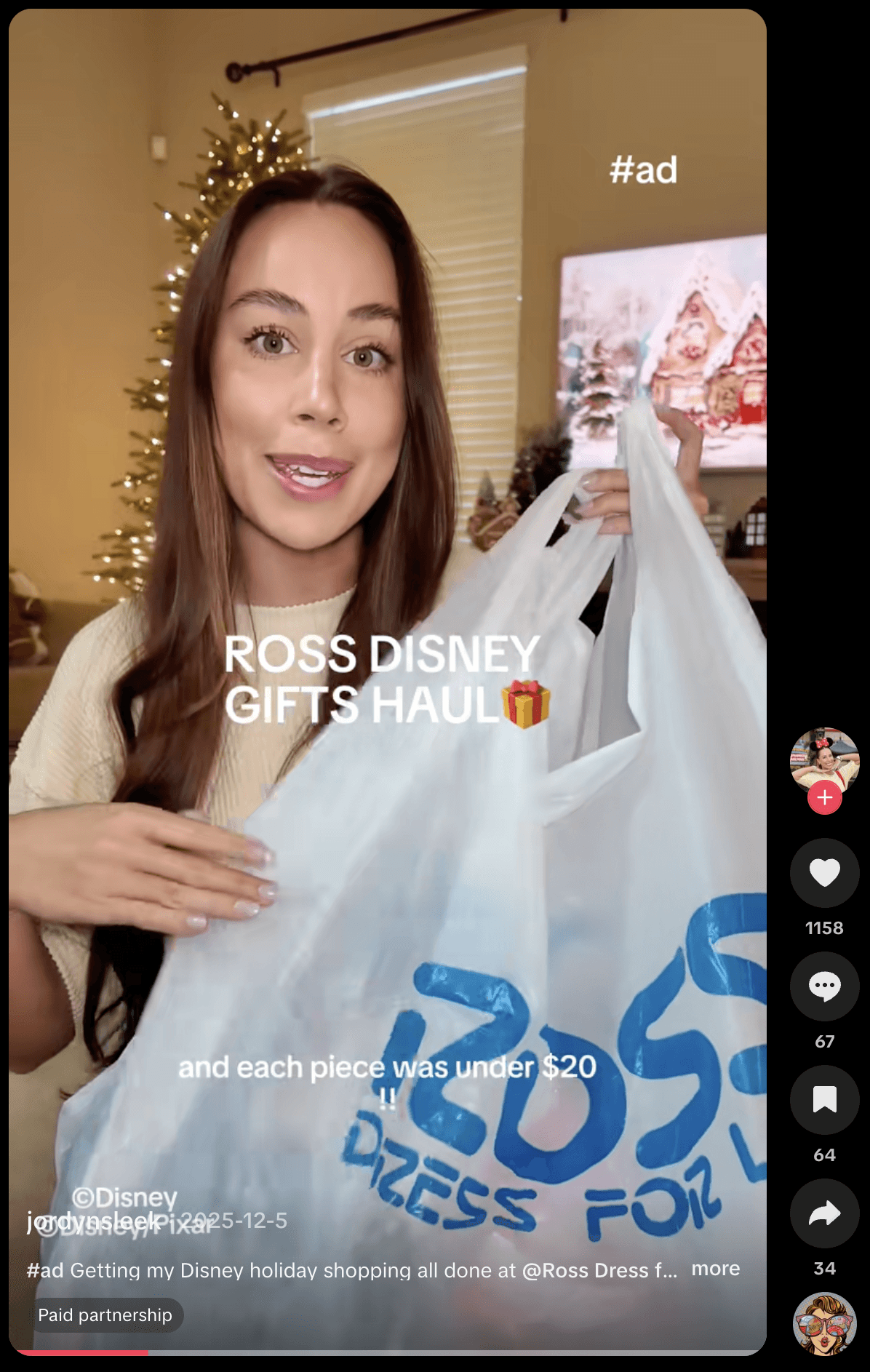

Ross Disney gift ideas: https://www.tiktok.com/@jordynsleek/video/7580064190086270222

Content Summary (generated by Syncly AI):The content creator shares Disney gift ideas from Ross, including jewelry, earrings, a Stitch-themed stocking stuffer, a Christmas blanket, and gifts for her niece and nephew.

2) Vibe Density (Experience per visit)

Retail “feels” like the product—decor, atmosphere, social ritual.

Marketing implication: Pick your lane per campaign.

Value campaigns need clear economics. Vibe campaigns need filmable moments.

Holiday Marketing Strategy 2026: The Action Checklist

If 2025 taught us anything, it’s that operations + trust + emotional framing are now core marketing levers.

1) Move the calendar earlier

Launch by early October to capture planners with “done-before-December” energy

2) Build two journeys (Planner vs Rescue)

Separate landing pages, creative, and offers

3) Engineer self-gifting into the funnel

Gift + treat bundles

checkout treat modules

gift card kicker programs

4) Make convenience a headline

clear shipping cutoff banners

fast pickup messaging

curated gift solutions

5) Invest in social video listening

Track spoken mentions + on-screen text, not just hashtags

Use it to detect early shifts in sentiment (stress, trust, pain points)

FAQ: 2025 Holiday Shopping Trends

Q: Did shoppers start earlier in 2025?

A: Yes—early shopping was framed as a stress reduction strategy and identity signal.

Q: What drove self-gifting?

A: Holiday labor + stress increased demand for small, controllable rewards.

Q: What should brands do differently in 2026?

A: Start earlier, run two funnels, and treat trust + convenience as growth drivers.

This 2025 holiday shopping recap is grounded in short-form social video listening across TikTok and Instagram Reels. We analyzed creator videos using spoken-word transcripts, captions, and repeated content formats to identify the season’s most consistent behavioral and sentiment patterns.

The headline insight: holiday spending didn’t freeze. It evolved. Shoppers became more calculated, optimizing for control (budgeting), convenience (delivery + pickup), and emotional payoff (self-gifting).

Methodology: Short-form Social Video Listening (TikTok + Instagram Reels)

This analysis synthesizes themes from the provided dataset of short-form social videos using:

Transcripts (what creators say out loud)

Captions + on-screen text (what they frame as the hook)

Recurring formats (haul, unboxing, GRWM, store walkthroughs, gift guides)

Behavioral evidence (in-store footage, pickup workflows, shopping pain points)

Here's how the high-level metrics unfolded in this analysis:

Total Volume: 2,147 posts (TikTok leads with 1,172 vs. Instagram 975)

Total Views: 368.4M (TikTok dominates with 342.8M views vs. Instagram 25.6M)

Engagement: 7.3M total (TikTok drives 6.9M, indicating higher viral potential)

2025 Holiday Shopping Recap: The Rise of the “Calculated Shopper”

Holiday 2025 was defined by a contradiction that showed up repeatedly in social video:

Economic anxiety (prices, household budgeting pressure)

Strategic spending (shopping earlier, optimizing deals, limiting impulse)

Small treat behavior (self-gifting as emotional regulation)

Shoppers weren’t saying, “I’m not spending.” They were saying, “I’m spending differently.”

Social video evidence (gift-on-a-budget framing):

Capital One budget gifting tips: https://www.tiktok.com/@capitalone/video/7581950291411619085

Content Summary (generated by Syncly AI): The content creator shares tips to make the holidays magical while staying on budget.

Holiday Shopping Trends 2025: Early Planners vs Last-Minute Rescue Shoppers

Short-form videos made one thing obvious: the season split into two different shopper journeys.

Segment 1: Early Planners (“Finishers”)

Creators framed early shopping as a lifestyle win—peace, organization, and less stress.

“Done before December” = status + sanity

Curated lists and one-stop shops reduce decision fatigue

Evidence (early shopping haul framing):

Walmart early holiday shopping: https://www.instagram.com/reels/DRP-0xCiUTT/

Content Summary (generated by Syncly AI): The content creator shares her early holiday shopping haul from Walmart, featuring gifts for her nieces and son.

Segment 2: Last-Minute Rescue Shoppers

Late shoppers weren’t optimizing price as much as optimizing certainty:

in-stock availability

delivery speed

low-effort gift solutions (bundles, stocking stuffers, “grab-and-go”)

Evidence (last-minute store run + chaos):

Target/TJ Maxx/Sam’s Club last-minute shopping: https://www.tiktok.com/@_mariclaremaclamroc_/video/7586792286122511671

Content Summary (generated by Syncly AI): A content creator documents their last-minute Christmas shopping trip for two four-year-olds at Target, TJ Maxx, and Sam's Club.

Marketing implication: Run two funnels.

Planner funnel: early access, curated gifts, “finish early” messaging

Rescue funnel: shipping cutoffs, BOPIS, express delivery, “gift in minutes” bundles

Holiday Consumer Behavior 2025: Budgeting Became a Ritual

Budgeting wasn’t just a constraint—it became content. Shoppers shared tactics and mindset rules:

spend-per-person caps

list-making and strict prioritization

“experiences over things” as a budget-safe narrative

Evidence (macro-to-wallet explanation + household spending pressure):

Tariffs + household budget stress: https://www.tiktok.com/@sheisapaigeturner/video/7576360223770758414

Content Summary (generated by Syncly AI): The content creator discusses how tariffs are driving up the cost of everyday goods and impacting families' budgets.

Marketing implication: If you want conversion, don’t just say “sale.”

Show why it’s worth it (value proof, utility, durability, bundle economics).

Self-Gifting Trend 2025: “Treat Yourself” as a Conversion Driver

Self-gifting wasn’t an afterthought—it was a conversion lever. Creators repeatedly normalized:

“Don’t forget yourself”

adding small items during gift shopping

low-ticket “little treats” as emotional payoff for holiday labor

Evidence (“treat yourself too” positioned as part of gifting):

Amazon “11 cent deal day” gifting + self treat: https://www.tiktok.com/@okaylookingdude/video/7571479169347947806

Content Summary (generated by Syncly AI): The content creator discusses how tariffs are driving up the cost of everyday goods and impacting families' budgets.

What marketers should do:

Add a “Pick a little treat” module at checkout (AOV lift)

Build “Gift + Treat” bundles (guilt-reduction = higher conversion)

Use offer framing that validates the shopper’s effort (“you earned this”)

The Mall Comeback: Why Social Video Pulled Shoppers Back In-Store

A strong holiday signal: in-store shopping returned as experience + content.

Mall trips were filmed as a social ritual (“sister date,” festive vibes)

Physical retail became a content backdrop for “shop with me” formats

Visual merchandising mattered because it became shareable media

Evidence (mall as vibe + social ritual):

“Meet me at the mall” holiday shopping: https://www.tiktok.com/@meriahchristine1/video/7579031424758566174

Content Summary (generated by Syncly AI): The content creator discusses how tariffs are driving up the cost of everyday goods and impacting families' budgets.

Marketing implication: Stores aren’t just distribution. They’re a media channel.

For the 2026 Holiday Shopping Season, Brands should design for:

“filmable” curated gift corners

obvious giftable moments

quick, confidence-building wayfinding

Holiday Shopping Pain Points: Burnout, Overstimulation, Decision Fatigue

Short-form video captured real friction—especially for parents:

overcrowded aisles and overstimulation

decision fatigue from endless options

the mental load of managing family gifting

Evidence (overwhelm + preference for curated solutions):

Nordstrom curated lists + easy pickup + easy returns: https://www.tiktok.com/@sydneyschiffer/video/7585282386997398797

Content Summary (generated by Syncly AI): The content creator promotes Nordstrom as a great place to shop for holiday gifts, both online and in-store.

Marketing implication: Convenience is not a feature. It’s a premium benefit.

Highlight:

curated gift lists

BOPIS speed

returns clarity

“stocking stuffer bundles” and “gift-ready sets”

What Worked in 2025: Value Density vs Vibe Density

Winning holiday strategies are clustered into two lanes:

1) Value Density (Extreme value per frame)

Hauls succeed when a creator can show many items for a low total. Discount retailers thrive because “visual abundance” drives engagement

Evidence (under $20 gift haul):

Ross Disney gift ideas: https://www.tiktok.com/@jordynsleek/video/7580064190086270222

Content Summary (generated by Syncly AI):The content creator shares Disney gift ideas from Ross, including jewelry, earrings, a Stitch-themed stocking stuffer, a Christmas blanket, and gifts for her niece and nephew.

2) Vibe Density (Experience per visit)

Retail “feels” like the product—decor, atmosphere, social ritual.

Marketing implication: Pick your lane per campaign.

Value campaigns need clear economics. Vibe campaigns need filmable moments.

Holiday Marketing Strategy 2026: The Action Checklist

If 2025 taught us anything, it’s that operations + trust + emotional framing are now core marketing levers.

1) Move the calendar earlier

Launch by early October to capture planners with “done-before-December” energy

2) Build two journeys (Planner vs Rescue)

Separate landing pages, creative, and offers

3) Engineer self-gifting into the funnel

Gift + treat bundles

checkout treat modules

gift card kicker programs

4) Make convenience a headline

clear shipping cutoff banners

fast pickup messaging

curated gift solutions

5) Invest in social video listening

Track spoken mentions + on-screen text, not just hashtags

Use it to detect early shifts in sentiment (stress, trust, pain points)

FAQ: 2025 Holiday Shopping Trends

Q: Did shoppers start earlier in 2025?

A: Yes—early shopping was framed as a stress reduction strategy and identity signal.

Q: What drove self-gifting?

A: Holiday labor + stress increased demand for small, controllable rewards.

Q: What should brands do differently in 2026?

A: Start earlier, run two funnels, and treat trust + convenience as growth drivers.

This 2025 holiday shopping recap is grounded in short-form social video listening across TikTok and Instagram Reels. We analyzed creator videos using spoken-word transcripts, captions, and repeated content formats to identify the season’s most consistent behavioral and sentiment patterns.

The headline insight: holiday spending didn’t freeze. It evolved. Shoppers became more calculated, optimizing for control (budgeting), convenience (delivery + pickup), and emotional payoff (self-gifting).

Methodology: Short-form Social Video Listening (TikTok + Instagram Reels)

This analysis synthesizes themes from the provided dataset of short-form social videos using:

Transcripts (what creators say out loud)

Captions + on-screen text (what they frame as the hook)

Recurring formats (haul, unboxing, GRWM, store walkthroughs, gift guides)

Behavioral evidence (in-store footage, pickup workflows, shopping pain points)

Here's how the high-level metrics unfolded in this analysis:

Total Volume: 2,147 posts (TikTok leads with 1,172 vs. Instagram 975)

Total Views: 368.4M (TikTok dominates with 342.8M views vs. Instagram 25.6M)

Engagement: 7.3M total (TikTok drives 6.9M, indicating higher viral potential)

2025 Holiday Shopping Recap: The Rise of the “Calculated Shopper”

Holiday 2025 was defined by a contradiction that showed up repeatedly in social video:

Economic anxiety (prices, household budgeting pressure)

Strategic spending (shopping earlier, optimizing deals, limiting impulse)

Small treat behavior (self-gifting as emotional regulation)

Shoppers weren’t saying, “I’m not spending.” They were saying, “I’m spending differently.”

Social video evidence (gift-on-a-budget framing):

Capital One budget gifting tips: https://www.tiktok.com/@capitalone/video/7581950291411619085

Content Summary (generated by Syncly AI): The content creator shares tips to make the holidays magical while staying on budget.

Holiday Shopping Trends 2025: Early Planners vs Last-Minute Rescue Shoppers

Short-form videos made one thing obvious: the season split into two different shopper journeys.

Segment 1: Early Planners (“Finishers”)

Creators framed early shopping as a lifestyle win—peace, organization, and less stress.

“Done before December” = status + sanity

Curated lists and one-stop shops reduce decision fatigue

Evidence (early shopping haul framing):

Walmart early holiday shopping: https://www.instagram.com/reels/DRP-0xCiUTT/

Content Summary (generated by Syncly AI): The content creator shares her early holiday shopping haul from Walmart, featuring gifts for her nieces and son.

Segment 2: Last-Minute Rescue Shoppers

Late shoppers weren’t optimizing price as much as optimizing certainty:

in-stock availability

delivery speed

low-effort gift solutions (bundles, stocking stuffers, “grab-and-go”)

Evidence (last-minute store run + chaos):

Target/TJ Maxx/Sam’s Club last-minute shopping: https://www.tiktok.com/@_mariclaremaclamroc_/video/7586792286122511671

Content Summary (generated by Syncly AI): A content creator documents their last-minute Christmas shopping trip for two four-year-olds at Target, TJ Maxx, and Sam's Club.

Marketing implication: Run two funnels.

Planner funnel: early access, curated gifts, “finish early” messaging

Rescue funnel: shipping cutoffs, BOPIS, express delivery, “gift in minutes” bundles

Holiday Consumer Behavior 2025: Budgeting Became a Ritual

Budgeting wasn’t just a constraint—it became content. Shoppers shared tactics and mindset rules:

spend-per-person caps

list-making and strict prioritization

“experiences over things” as a budget-safe narrative

Evidence (macro-to-wallet explanation + household spending pressure):

Tariffs + household budget stress: https://www.tiktok.com/@sheisapaigeturner/video/7576360223770758414

Content Summary (generated by Syncly AI): The content creator discusses how tariffs are driving up the cost of everyday goods and impacting families' budgets.

Marketing implication: If you want conversion, don’t just say “sale.”

Show why it’s worth it (value proof, utility, durability, bundle economics).

Self-Gifting Trend 2025: “Treat Yourself” as a Conversion Driver

Self-gifting wasn’t an afterthought—it was a conversion lever. Creators repeatedly normalized:

“Don’t forget yourself”

adding small items during gift shopping

low-ticket “little treats” as emotional payoff for holiday labor

Evidence (“treat yourself too” positioned as part of gifting):

Amazon “11 cent deal day” gifting + self treat: https://www.tiktok.com/@okaylookingdude/video/7571479169347947806

Content Summary (generated by Syncly AI): The content creator discusses how tariffs are driving up the cost of everyday goods and impacting families' budgets.

What marketers should do:

Add a “Pick a little treat” module at checkout (AOV lift)

Build “Gift + Treat” bundles (guilt-reduction = higher conversion)

Use offer framing that validates the shopper’s effort (“you earned this”)

The Mall Comeback: Why Social Video Pulled Shoppers Back In-Store

A strong holiday signal: in-store shopping returned as experience + content.

Mall trips were filmed as a social ritual (“sister date,” festive vibes)

Physical retail became a content backdrop for “shop with me” formats

Visual merchandising mattered because it became shareable media

Evidence (mall as vibe + social ritual):

“Meet me at the mall” holiday shopping: https://www.tiktok.com/@meriahchristine1/video/7579031424758566174

Content Summary (generated by Syncly AI): The content creator discusses how tariffs are driving up the cost of everyday goods and impacting families' budgets.

Marketing implication: Stores aren’t just distribution. They’re a media channel.

For the 2026 Holiday Shopping Season, Brands should design for:

“filmable” curated gift corners

obvious giftable moments

quick, confidence-building wayfinding

Holiday Shopping Pain Points: Burnout, Overstimulation, Decision Fatigue

Short-form video captured real friction—especially for parents:

overcrowded aisles and overstimulation

decision fatigue from endless options

the mental load of managing family gifting

Evidence (overwhelm + preference for curated solutions):

Nordstrom curated lists + easy pickup + easy returns: https://www.tiktok.com/@sydneyschiffer/video/7585282386997398797

Content Summary (generated by Syncly AI): The content creator promotes Nordstrom as a great place to shop for holiday gifts, both online and in-store.

Marketing implication: Convenience is not a feature. It’s a premium benefit.

Highlight:

curated gift lists

BOPIS speed

returns clarity

“stocking stuffer bundles” and “gift-ready sets”

What Worked in 2025: Value Density vs Vibe Density

Winning holiday strategies are clustered into two lanes:

1) Value Density (Extreme value per frame)

Hauls succeed when a creator can show many items for a low total. Discount retailers thrive because “visual abundance” drives engagement

Evidence (under $20 gift haul):

Ross Disney gift ideas: https://www.tiktok.com/@jordynsleek/video/7580064190086270222

Content Summary (generated by Syncly AI):The content creator shares Disney gift ideas from Ross, including jewelry, earrings, a Stitch-themed stocking stuffer, a Christmas blanket, and gifts for her niece and nephew.

2) Vibe Density (Experience per visit)

Retail “feels” like the product—decor, atmosphere, social ritual.

Marketing implication: Pick your lane per campaign.

Value campaigns need clear economics. Vibe campaigns need filmable moments.

Holiday Marketing Strategy 2026: The Action Checklist

If 2025 taught us anything, it’s that operations + trust + emotional framing are now core marketing levers.

1) Move the calendar earlier

Launch by early October to capture planners with “done-before-December” energy

2) Build two journeys (Planner vs Rescue)

Separate landing pages, creative, and offers

3) Engineer self-gifting into the funnel

Gift + treat bundles

checkout treat modules

gift card kicker programs

4) Make convenience a headline

clear shipping cutoff banners

fast pickup messaging

curated gift solutions

5) Invest in social video listening

Track spoken mentions + on-screen text, not just hashtags

Use it to detect early shifts in sentiment (stress, trust, pain points)

FAQ: 2025 Holiday Shopping Trends

Q: Did shoppers start earlier in 2025?

A: Yes—early shopping was framed as a stress reduction strategy and identity signal.

Q: What drove self-gifting?

A: Holiday labor + stress increased demand for small, controllable rewards.

Q: What should brands do differently in 2026?

A: Start earlier, run two funnels, and treat trust + convenience as growth drivers.

Build a brand customers love with Syncly

Build a brand customers love with Syncly